Financial Planning for Mental Peace: Building a Stress-Free Budget

Ever find yourself staring blankly at your bank account, wondering where all your money went? You’re not alone. Many of us, especially those navigating demanding careers or rigorous studies, often let financial planning take a back seat. But neglecting your finances can lead to stress, anxiety, and even impact your overall well-being. A well-structured budget isn't just about numbers; it's about creating a sense of control and security, freeing up mental space to focus on what truly matters.

Why a Stress-Free Budget Matters

Imagine knowing exactly where your money is going each month. No more frantic bill-paying, no more guessing if you can afford that weekend getaway, and no more sleepless nights worrying about unexpected expenses. That’s the power of a stress-free budget. It's about designing a financial plan that aligns with your values and goals, giving you a clear roadmap to achieve them. This is particularly relevant for those in demanding fields like mechanical engineering, where mental clarity and focus are essential for problem-solving and innovation.

For students, a budget allows you to manage tuition costs, books, and living expenses effectively, reducing the financial burden and allowing you to concentrate on your studies. For professionals, especially those dealing with high-pressure projects and deadlines, a budget can provide a sense of stability and control, leading to better work-life balance and reduced burnout. Ignoring your finances is like ignoring material strength in structural design – sooner or later, something will fail under the pressure.

Step-by-Step Guide to Building Your Budget

Building a budget doesn’t have to be complicated. Here's a straightforward process to get you started:

1. Calculate Your Income

Start by determining your net income – the amount you take home after taxes and other deductions. This is the foundation of your budget. If your income fluctuates, average your earnings over the past few months to get a more accurate picture. Be honest with yourself; include all sources of income, even small side hustles.

2. Track Your Expenses

This is where many people stumble, but it's crucial. For a month, meticulously track every penny you spend. Use a budgeting app, a spreadsheet, or even a notebook. Categorize your expenses into fixed expenses (rent, loan payments) and variable expenses (groceries, entertainment). Don't underestimate the power of knowing where your money goes. You might be surprised to find hidden spending habits.

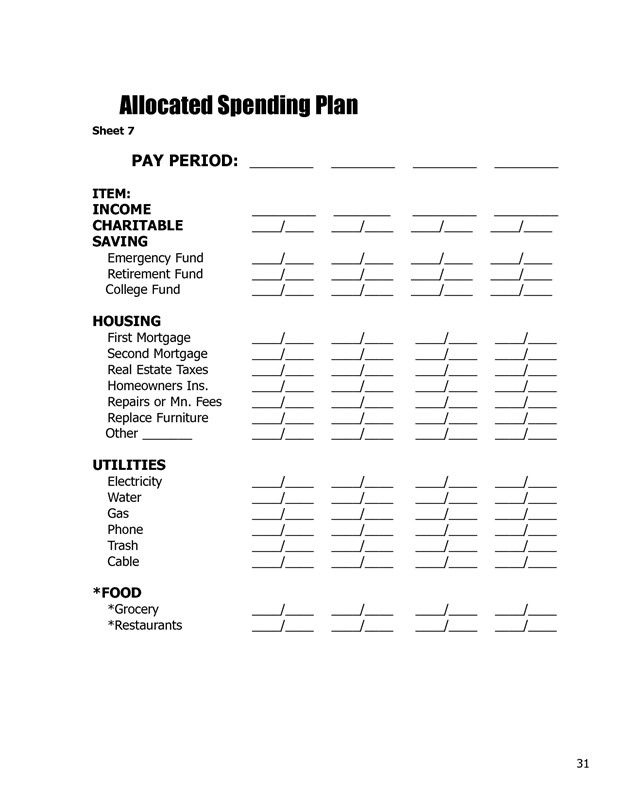

3. Create Expense Categories

Break down your expenses into manageable categories. Common categories include: Housing, Transportation, Food, Utilities, Debt Payments, Entertainment, Savings, and Personal Care. The more detailed you are, the easier it will be to identify areas where you can potentially cut back. Think of these categories like different components in a machine; each needs to be accounted for to ensure the whole system runs smoothly.

4. Allocate Funds and Prioritize

Now comes the budgeting part. Based on your income and expense tracking, allocate funds to each category. Prioritize essential expenses like housing, food, and debt payments. Then, consider your values and goals. Do you want to travel more? Invest in your education? Save for a down payment on a house? Adjust your spending to align with these priorities. This is where you make conscious decisions about where your money goes.

5. Monitor and Adjust

Your budget isn't set in stone. Regularly monitor your spending and compare it to your budget. Are you overspending in certain categories? Are you meeting your savings goals? Make adjustments as needed. Life changes, and your budget should reflect those changes. Treat your budget as a dynamic tool that evolves with you.

Budgeting Methods: Find What Works for You

There's no one-size-fits-all approach to budgeting. Experiment with different methods to find what suits your lifestyle and personality:

The 50/30/20 Rule

Allocate 50% of your income to needs (housing, food, transportation), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment. This is a simple and flexible approach that works well for many people.

Zero-Based Budgeting

Assign every dollar a purpose, so that your income minus your expenses equals zero. This method provides a high level of control and ensures that every penny is accounted for. This is akin to failure analysis: pinpointing every weakness to prevent future issues.

Envelope Budgeting

Use physical envelopes to allocate cash for different categories. This can be particularly effective for controlling variable expenses like groceries or entertainment. Once the money in the envelope is gone, you're done spending in that category for the month.

Tools and Resources for Budgeting

Numerous tools can help you create and manage your budget:

- Budgeting Apps: Mint, YNAB (You Need a Budget), Personal Capital. These apps automate expense tracking and provide valuable insights into your spending habits.

- Spreadsheets: Create your own custom budget using Excel or Google Sheets.

- Financial Advisors: Consider consulting with a financial advisor for personalized guidance and support.

Remember, the best tool is the one you’ll actually use consistently. Don’t be afraid to try different options until you find the perfect fit.

Pros and Cons of Budgeting

Budgeting, like any tool, has advantages and disadvantages.

Pros:

- Reduced stress and anxiety

- Increased financial awareness

- Achievement of financial goals

- Improved savings habits

- Greater control over your money

Cons:

- Time commitment

- Requires discipline and consistency

- Can feel restrictive if not implemented properly

- May require difficult spending decisions

The key is to focus on the benefits and view your budget as a tool to empower you, not restrict you.

The Link Between Financial Stability and Mental Well-being

Numerous studies have shown a strong correlation between financial stability and mental well-being. When you have a clear understanding of your finances and a plan for the future, you experience less stress, anxiety, and depression. This allows you to focus on your work, your relationships, and your personal growth. It's like ensuring the tensile and compressive stress on a component is within acceptable limits – preventing catastrophic failure of your personal well-being.

FAQs

What if I have trouble sticking to my budget?

Don't be discouraged! It's common to slip up occasionally. The key is to identify the triggers that cause you to overspend and develop strategies to avoid them. Consider setting realistic goals, rewarding yourself for reaching milestones, and seeking support from friends or family.

How often should I review my budget?

At a minimum, review your budget monthly. However, more frequent reviews (weekly or even daily) can be helpful, especially when you're first starting out or experiencing significant changes in your income or expenses.

What if my income is unpredictable?

If your income fluctuates, focus on creating a conservative budget based on your lowest expected earnings. Then, when you earn more, allocate the extra money to savings or debt repayment. This helps you build a financial cushion and manage the uncertainty.

Is it okay to adjust my budget if my priorities change?

Absolutely! Your budget should be a reflection of your current values and goals. As your priorities evolve, adjust your budget accordingly. This ensures that your financial plan remains aligned with your life.

How can I save money without feeling deprived?

Focus on cutting back on unnecessary expenses rather than depriving yourself of things you enjoy. Look for creative ways to save money, such as cooking at home more often, finding free entertainment options, or negotiating better deals on your bills. Small changes can add up over time.

Should I include fun money in my budget?

Yes! It's important to allocate some funds for fun and recreation. This helps prevent burnout and ensures that your budget is sustainable in the long run. Don't view your budget as a restriction; view it as a tool to help you live a fulfilling and enjoyable life.

Conclusion

Building a stress-free budget is an investment in your mental well-being. By taking control of your finances, you can reduce anxiety, improve your focus, and achieve your goals. Start small, be patient, and remember that every step you take towards financial stability is a step towards greater peace of mind. Don't wait; start building your financial foundation today!

Posting Komentar untuk "Financial Planning for Mental Peace Building a Stress-Free Budget"